Table of Contents

In the realm of B2B sales, companies have two primary routes to engage customers and drive revenue: direct sales and indirect sales.

These approaches represent distinct strategies for reaching target clients and building a market presence.

Direct sales involves a company’s internal sales team engaging directly with potential customers to present products or services, negotiate terms, and close deals.

On the other hand, Indirect sales involve partnering with third-party distributors, resellers, agents, or other intermediaries who interact with customers on behalf of the company.

Test Your Knowledge about Direct Vs Indirect Sales

So what are the key differences between these two routes and which one should your company choose?

Let’s find out

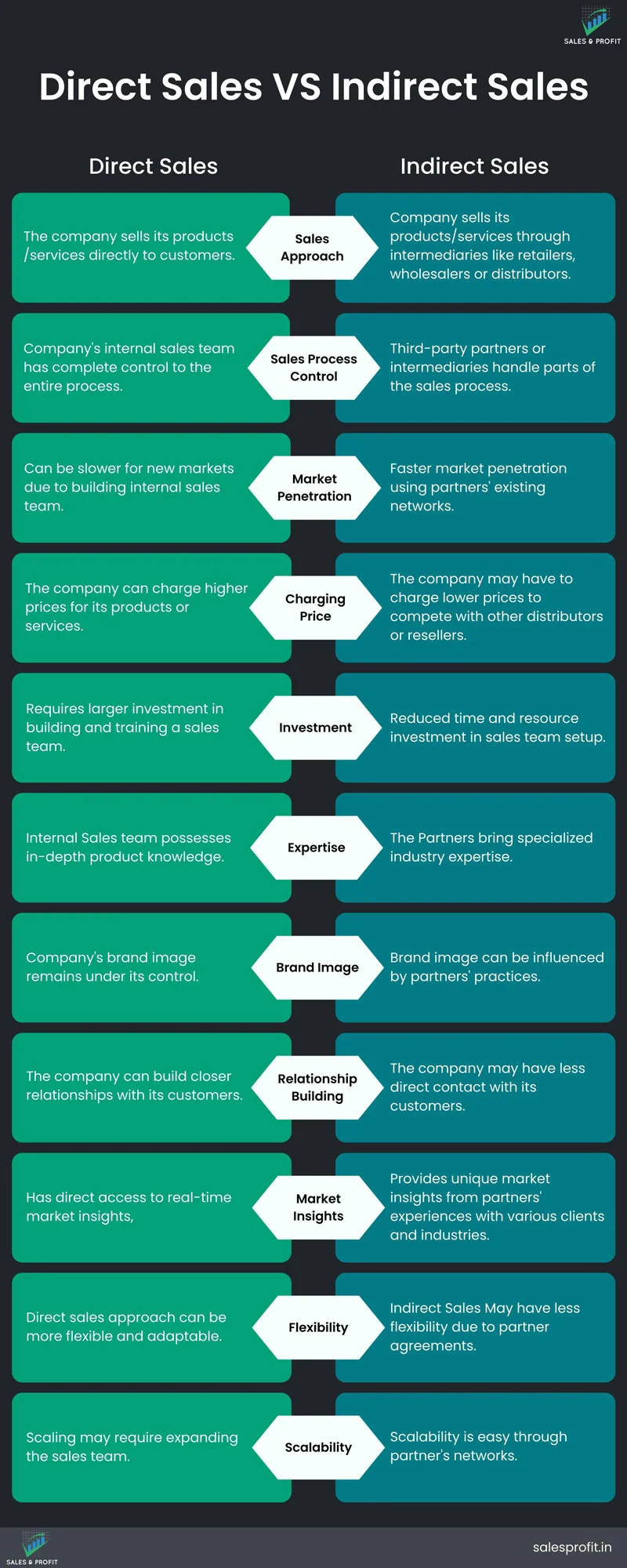

Difference Between Direct Sales & Indirect Sales

(Click on the image to enlarge)

1. Sales Approach

Direct Sales :

- The company formulates the sales strategy and has complete control over the entire process from targeting prospects to closing deals.

- Field sales and inside sales teams identify potential accounts, reach out to contacts, demonstrate product value, negotiate pricing & terms, send proposals and enable conversion.

- The sales approach and messaging is defined by the company’s sales leadership. Revenue funnel flows completely within the organization through its sales personnel

Indirect Sales :

- The company has to depend on channel partners like distributors, retailers, etc. to drive sales of its products in the market.

- These external entities devise their own sales strategies and action plans to push the company’s offerings to end customers.

- The company provides guidance in terms of potential customer segments, marketing content, etc. But sales execution depends entirely on the channel partners.

2. Sales Process Control

Direct Sales :

- The company’s sales leadership and internal teams have full visibility and control over the entire revenue funnel.

- They can track metrics around lead generation, prospecting calls, opportunities created, proposal shaping, negotiation processes and closure rates.

- If there are any gaps identified, corrective measures can be taken by evolving sales strategy, fine tuning processes, enabling teams through sales training etc.

Indirect Sales :

- The company depends on external channel partners to execute sales processes based on broad guidelines.

- Once sales rights are assigned to distributors or retailers, they take over account acquisition and relationship management.

- The company has minimal visibility on key funnel metrics around proposal timelines, pricing stages, closure rates etc. being driven by channel partners through their network.

3. Market Penetration

Direct Sales :

- Companies need to make significant investments to acquire customers directly through in-house teams. Building a skilled sales force with robust processes takes time.

- So initially depth and speed of market penetration is slower as organizational sales bandwidth gets created gradually.

- But over a period, companies can penetrate focused segments deeply through account-based approaches leveraging direct customer relationships.

Indirect Sales :

- Onboarding channel partners who already have well-defined customer access enables rapid market reach for companies.

- Partners bring their existing distribution infrastructure, account relationships and industry expertise. This ensures wider and faster penetration.

- However, company has relatively less control over which customer profiles are getting targeted by external partners.

4. Pricing

Direct Sales :

- Companies have flexibility to decide optimal pricing models and price points for customers since direct sales teams manage the full cycle.

- They also bundle products/services and negotiate competitive price and payment terms during customer conversations.

- Direct customer access also provides market signals around price thresholds and buyer willingness for certain propositions which can be levered.

Indirect Sales :

- Channel margins have to be factored into base pricing leading to lower control for the company on final price to end users.

- Distributors or retailers negotiate quantity based pricing with companies and sell onwards to buyers at margins suitable for them.

- Route-to-market costs get added resulting in customer prices shaped more by channel eco-system.

5. Investment Required

Direct Sales :

- Companies have to make sizable investments in recruiting, onboarding, and training sales teams to execute direct selling.

- Sales force needs to be mapped to targeted customer segments across required competencies like domain expertise, solution mapping, negotiation etc.

- Investments also go behind establishing robust sales processes, analytics, tech infrastructure for the in-house teams to effectively generate and close deals.

Indirect Sales :

- Onboarding channel partners saves significant investments as their personnel engage directly with customers for sales.

- Companies also save costs related to building large sales teams, providing training and sales infra required otherwise for a direct sales approach.

- However, investments may be needed upfront to appoint country or region level distributors or retail partners through negotiations. But overall costs are lower.

6. Expertise

Direct Sales :

- In direct selling, the company’s own sales teams gain specialized expertise across industry domains, customer categories and deal management through consistent engagement.

- Being focused on select target segments also enables depth of solution capability and tailored positioning for different customer profiles.

Indirect Sales :

- Channel partners already possess industry-specific operating experience as well as existing buyer relationships within their geographies.

- Distributors and retailers bring their own capabilities around local customer preferences, negotiations, after-sales support based on infrastructure and people available with them.

7. Brand Image Control

Direct Sales :

- With in-house sales teams directly engaging customers, companies have higher control over brand perception and experience during buying journey.

- Sales messaging, marketing campaigns, product packaging, pricing models etc. can be tailored for positioning without external influence.

- Direct customer feedback also provides signals on how to evolve engagement models to build a consistent brand image.

Indirect Sales :

- Dependence on third-party partners for sales execution means lower influence over customer touch-points for companies.

- Distributors focusing only on volume-based financial deals may end up damaging brand equity through transactional relationships.

- Lack of direct customer access also cuts off important signals around strengths and blind spots impacting brand positioning.

8. Relationship Building With Customers

Direct Sales :

- Companies using direct sales models have the advantage of depth in account relationships as the sales teams focuses on select key accounts.

- Customized solutions for specific customer pain areas help in emotionally connecting buyer decision makers with key contacts.

- Account history, context and visions are better understood internally enabling more strategic partnerships.

Indirect Sales :

- Channel partners own customer relationships in indirect sales, limiting the ability of companies to directly build connections.

- With distributed sales operations, context behind accounts is also not available leading to transactional interactions than strategic relationships.

- Dependence on distributor relationship managers for access usually results in company contacts being seen as sales reps limiting depth.

9. Market Insights

Direct Sales :

- Due to consistent account level engagement with customers across sectors, direct sales teams develop sharper market insights.

- Emerging trends around substitute products, competitor positioning arises from field interactions providing smarter market signals.

- Segment-specific pain areas, budget thresholds also become visible aiding decision making on company priorities.

Indirect Sales :

- Although depth of customer immersion is lower, indirect models provide width of market understanding across wider base touching distributed locations.

- Trends around downstream buy-side behavior, purchasing choices apparent at a broader level through channel sales data.

- Provides complementing macro insights into mass market vs direct sales fuelling niche segment perspective.

10. Flexibility

Direct Sales :

- Companies have higher flexibility around sales models and strategies with internal teams directly managing the customer interface and sales processes.

- There is agility in responding to market changes through tweaks in value proposition, pricing, solution bundling based on direct field trends and buyer conversations.

- No long-term commitments typical of channel partner agreements enhancement the ability to pivot targeted customer sectors, geographies and solution offerings.

Indirect Sales :

- Due to agreements with distributors, retailers invested in infrastructure to sell company’s current products, shifting models becomes harder.

- Channel margins, distribution cost economics, also pose relatively lower flexibility around tweaks in pricing strategies impacting company unit revenue realization.

- However, scale achieved through external partners enables volume-based cost efficiencies in productions offering stability of operations.

11. Scalability

Direct Sales :

- Increasing reach and penetration into newer markets requires significant additions to sales team strength through fresh recruiting and training.

- Scaling also needs increased investments into sales systems, analytics, operational processes to absorb higher volumes flowing through direct selling funnel.

- Sales management bandwidth also needs to expand to ensure sales productivity and deal closure rates are not impacted during growth.

Indirect Sales :

- Scaling distribution footprint across wider geographies by onboarding more channel partners is relatively easier due to asset-light model.

- By adding more regional distributors or retail store chains, companies can efficiently scale sales substantially without investing into internal capability enhancement.

- However, joint value planning and clear communication on growth expectations become important for alignment and to protect brand integrity.

When to Choose Direct Sales Route?

1. Complex Solutions

If your products or services are complex, requiring in-depth understanding, customization and more specialized knowledge to sell, direct sales route is the more appropriate one.

2. Strategic Accounts

For key accounts with high revenue potential, direct sales enable building strong relationships and tailoring solutions to their specific needs.

3. Control on Brand Identity

If maintaining control over the sales process, brand image, and customer interactions is crucial to your company’s strategy, direct sales offer the highest level of control.

4. Large Deal Sizes

Direct sales is suitable for larger deals where negotiations, customization, and close engagement with decision-makers are essential.

5. Small Target Market

If the target market you’re trying to enter is small and concentrated, a direct sales route may be more effective.

As it allow you to educate potential customers, establish your presence, and gather market insights.

6. Long Sales Cycles

If you’re in an industries with longer and complex sales cycles, direct sales can maintain personalized communication throughout the process, building trust and addressing evolving needs.

Are You Facing Any Sales Challenges?

If Yes, request a 100% free “no obligation” sales consulting call where we will understand your current sales challenges and help you with proven methods to solve those and improve your sales metrics and grow your revenue.

(Already 100+ B2B companies have seen growth in their sales and revenue with us)

When to Choose Indirect Sales Route?

1. Cost Efficiency

It requires huge investment in recruiting sales talents and managing the sales team.

So, if reducing operating costs is a priority, leveraging existing partner networks can be more cost-effective than maintaining a large direct sales force.

2. Broad Market Reach

If your target market is large and dispersed, indirect sales can allow you to quickly access a broader audience through partners who already have established relationships and market presence.

3. New Geographical Expansion

If you’re planning to enter new regions where you have no presence, local partners can provide valuable insights and connections needed to quickly expand

4. Resource Limitations

If your company lacks the resources or expertise to build and manage a direct sales team, partnering with experienced distributors, resellers, or agents is a prudent choice.

5. Volume Sales

If your goal is to achieve high sales volumes and market penetration, leveraging partners’ networks can help you reach a larger customer base more fast and efficiently.

6. Channel Flexibility

If your product/ service can be sold through a variety of channels, then indirect sales makes sense.

As it allow you to tap into different distribution channels through the partners and caterer to various customer preferences.

7. Reducing Risk

Sharing the sales burden with partners can mitigate risks associated with market fluctuations and economic uncertainties.

Conclusion

In conclusion, the dynamic nature of B2B sales mandates adaptability.

Success isn’t singularly tied to choosing between direct and indirect sales.

It rests in choosing a strategy that aligns with your company’s product/ service, goals and aspirations.

As markets evolve and customer expectations transform, maintaining an open-minded approach and a willingness to experiment with both approaches will undoubtedly position businesses to thrive.

Through our sales consulting intervention, we help companies create their Go to Market strategy and suggest which route they should take to expand their business